Getting Ready for Election Year 2027: Types of Insurance You Should Consider

As Kenya gradually moves toward the 2027 General Election, individuals and businesses alike must begin preparing. Election years often come with uncertainty, heightened activity, and increased risk exposure. Therefore, proactive planning becomes essential. Whether you are a business owner, school operator, transport provider, property owner, or individual professional, having the right insurance coverage during election year can protect you from unexpected disruptions.

Why Insurance Matters During an Election Year

Historically, election seasons can affect:

- Business operations

- Supply chains

- Property security

- Public transport activity

- Cash flow stability

- Employee safety

As a result, reviewing your insurance policy coverage before the 2027 election is not just advisable, it is strategic risk management.

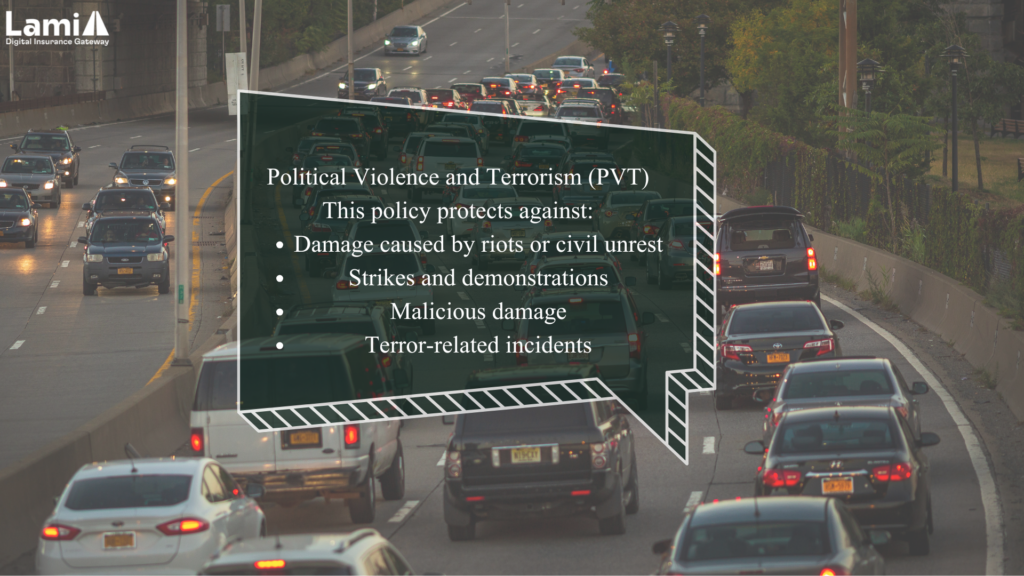

1. Political Violence and Terrorism (PVT) Insurance

Political Violence and Terrorism Insurance (PVT) is one of the most important covers to consider in an election year. This policy protects against:

- Damage caused by riots or civil unrest

- Strikes and demonstrations

- Malicious damage

- Terror-related incidents

For businesses, landlords, schools, and retail outlets, this cover can provide much-needed financial protection if operations are disrupted due to election-related unrest.

2. Business Interruption Insurance

In addition, Business Interruption Insurance ensures that if your business temporarily shuts down due to insured risks, you can still recover lost income. For example:

- If premises are damaged

- If access to your shop or office is restricted

- If operations are disrupted due to unrest

This cover helps maintain financial stability and business continuity.

3. Motor Insurance (Especially for PSV & Fleet Owners)

Moreover, transport activity often increases during election campaigns and voting periods. At the same time, risk exposure may also rise. It is therefore crucial for:

- PSV operators

- Fleet managers

- School bus owners

- Delivery companies

To ensure comprehensive motor insurance coverage, including political violence extensions where applicable.

4. Property Insurance

Similarly, homeowners, landlords, and commercial property owners should reassess their property insurance policies. Ensure your cover includes:

- Fire damage

- Riot and strike cover

- Political violence extensions

- Malicious damage

With the right property insurance in place, you safeguard your investments against unforeseen election-related events.

5. Medical Insurance

In times of uncertainty, personal well-being becomes even more critical. Therefore, individuals and organizations should confirm that their medical insurance plans are active and adequate. Businesses should also review staff medical cover limits to ensure employees remain protected.

6. Group Personal Accident (GPA) Cover

Additionally, organizations with field staff, activation teams, logistics personnel, or security personnel may consider Group Personal Accident insurance. This cover provides financial support in case of:

- Accidental injury

- Disability

- Accidental death

During heightened activity periods, this added protection can provide peace of mind.

Preparation is Better Than Recovery

Ultimately, getting ready for the 2027 election year in Kenya requires foresight, stability, and smart risk management. While we hope for peaceful transitions and smooth processes, preparing for all possibilities ensures resilience. Therefore, now is the time to:

- Review existing insurance policies

- Upgrade relevant covers

- Add political violence extensions

- Consult insurance advisors for tailored solutions

Election years do not have to mean uncertainty. With the right insurance solutions for 2027, individuals and businesses can move forward confidently, knowing they are protected against potential risks.