In today’s fast-paced business world, protecting your company and employees is paramount. For corporates and SMEs in Kenya, Workplace Injury Benefits Act (WIBA) insurance offers a safety net, ensuring financial security in the face of unforeseen accidents and injuries.

In this blog post, we explore the invaluable benefits of WIBA insurance and how we at Lami are revolutionizing insurance accessibility for businesses in Kenya

Understanding WIBA insurance

WIBA insurance, mandated by the Government of Kenya, is designed to provide compensation and benefits to employees who sustain injuries or disabilities while on duty. These benefits include medical expenses, disability coverage, and funeral expenses in the unfortunate event of an employee’s death. For corporates and SMEs, WIBA insurance is not only a legal requirement but also a fundamental aspect of corporate responsibility and employee welfare.

Understanding WIBA insurance

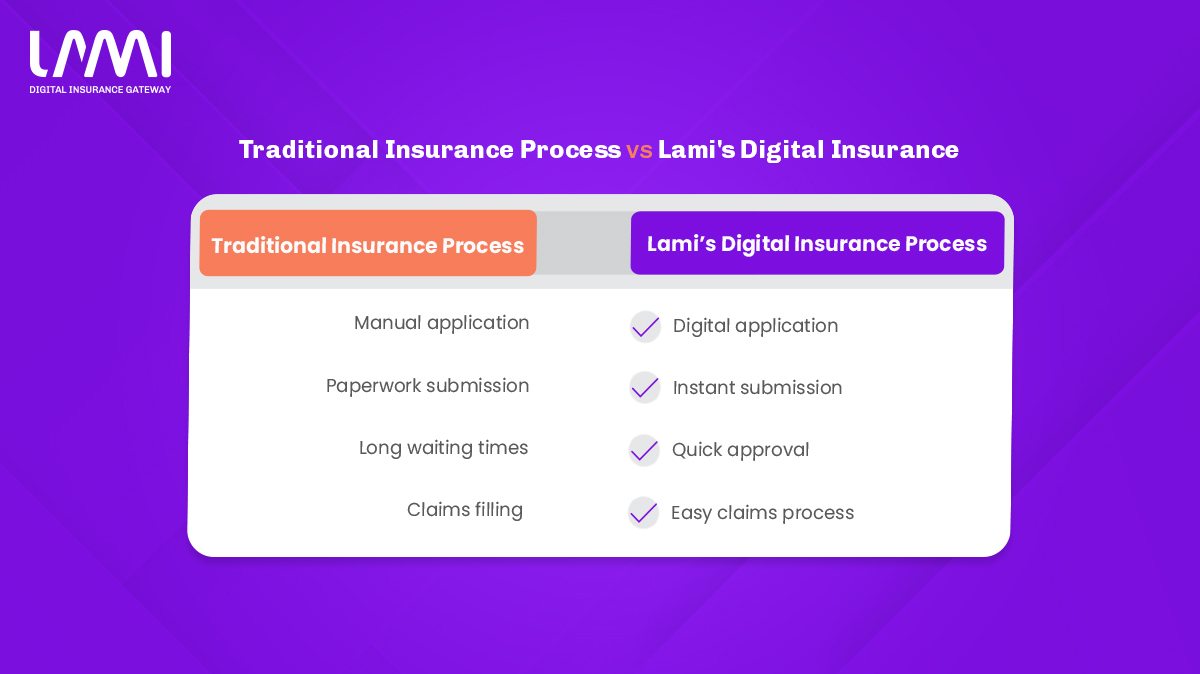

At Lami, we are redefining the insurance landscape in Kenya. With a user-friendly digital platform, we are empowering businesses to access and customize insurance coverage tailored to their unique needs. Gone are the days of cumbersome paperwork and time-consuming processes; we offer a seamless and efficient insurance experience

Tailored coverage for Kenyan companies

One of the standout features of our WIBA insurance is its flexibility. Businesses can tailor their insurance plans to suit their specific requirements. Whether it’s customizing coverage levels, adding additional benefits, or adjusting premium rates, we put the power of choice not in the hands of the corporates and SMEs, ensuring they receive the most relevant and cost-effective coverage

Simplified claims process

We understand that navigating the claims process can be daunting for businesses. Hence, we have made it our mission to simplify and expedite the claims process. With our digital platform, businesses can submit claims effortlessly, and our dedicated team ensures swift processing, providing peace of mind when it matters most.

Simplified claims process

Our WIBA insurance offers several advantages over traditional insurance providers. Firstly, the digital-first approach eliminates the need for lengthy paperwork, allowing businesses to focus on their core operations. Secondly, our platform empowers corporates and SMEs to manage their insurance policies efficiently, making amendments or renewals with ease.

Realizing the importance of WIBA insurance

Beyond mere compliance, WIBA insurance is an essential investment in protecting your business and workforce. As workplace accidents can occur at any time, having the right coverage in place can mitigate financial risks and ensure uninterrupted business operations. By opting for WIBA insurance, Kenyan businesses embrace a proactive approach to safeguard their employees and secure their future.

In conclusion, WIBA insurance is a vital shield for corporate and SMEs in Kenya, providing financial protection and reassurance to both businesses and their employees. By partnering with us, businesses can embrace a digital-first approach to insurance, benefiting from tailored coverage and a streamlined claims process. We are empowering Kenyan businesses to face the future with confidence, knowing that their insurance needs are in safe and capable hands.